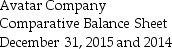

Avatar Auto Parts Company uses the indirect method to prepare its statement of cash flows.Refer to the following portion of the comparative balance sheet:

Additional information provided by the company includes the following:

Additional information provided by the company includes the following:

Equipment costing $104,000 was purchased for cash.

Equipment with a net asset value of $20,000 was sold for $28,000.

Depreciation Expense of $24,000 was recorded during the year.

Prepare the investing activities section of the statement of cash flows.

Definitions:

Deduct

Deduct refers to the act of subtracting an amount from a total, often used in financial contexts such as subtracting expenses or costs from income to calculate taxable income.

AGI

AGI, short for Adjusted Gross Income, is an individual's total gross income minus specific deductions, used to determine how much of one's income is taxable.

Rental Activity

Engaging in the act of renting out property or equipment as a business operation to generate income.

AMT Adjustments

Modifications made to calculate the Alternative Minimum Tax (AMT), aiming to ensure that high-income earners pay a minimum amount of income tax.

Q10: If a bond is issued at a

Q14: Which of the following is the typical

Q28: The total amount of manufacturing overhead costs

Q28: The information related to interest expense of

Q45: Gains and losses on the sale of

Q47: Which of the following will happen to

Q59: If an investor wants to know the

Q127: Prior period adjustments _.<br>A)always increase the beginning

Q136: On June 30,Cleopatra Inc.finished Job 70 with

Q164: Service companies do not have product costs