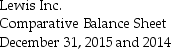

Lewis Inc.uses the indirect method to prepare its statement of cash flows.Refer to the following portion of the comparative balance sheet:

Additional information provided by the company includes the following:

Additional information provided by the company includes the following:

Equipment costing $104,000 was purchased for cash.

Equipment with a net asset value of $20,000 was sold for $28,000.

Depreciation Expense of $24,000 was recorded during the year.

With the help of T-account format,analyze the transactions affecting Property,Plant & Equipment,net.

Definitions:

Raw Materials Inventory

Raw Materials Inventory is the stock of materials that are on hand and available for use in the production process.

Finished Goods Inventory

Products that have completed the manufacturing process and are ready to be sold to customers.

Weighted Average Cost

A method of calculating the cost of goods sold and ending inventory cost by taking into account the cost of goods purchased at varying prices.

Beginning Inventory

The value of a company's inventory at the start of an accounting period, used in calculating cost of goods sold.

Q25: Ross Corporation reported the following equity section

Q44: One of the primary activities of Rex

Q46: The third section presented on the statement

Q52: Ropers Inc.purchases 7,000 shares of its own

Q63: A corporation's income statement includes some unique

Q74: The study of percentage changes in comparative

Q100: On March 1,2015,Vantage Services issued a 5%

Q103: Which of the following statements accurately describes

Q121: On March 21,2013,the bond accounts of Urban

Q134: The cash flow from investing activities section