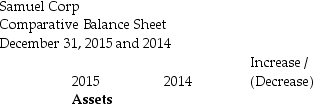

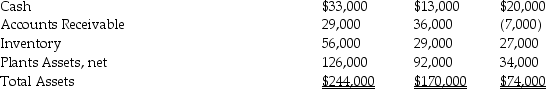

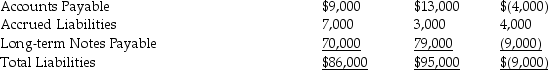

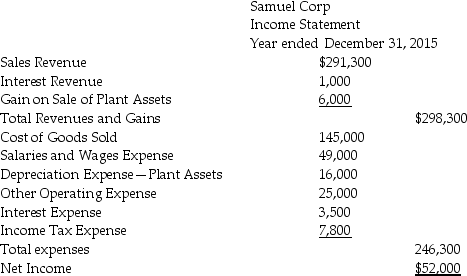

Samuel Corp.has provided the following information for the year ended December 31,2015.

Current Assets:

Current Assets:

Additional information provided by the company includes the following:

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net asset value of $10,000 was sold for $16,000.

Depreciation Expense of $16,000 was recorded during the year.

During 2014,the company repaid $43,000 of Long-Term Notes Payable.

During 2014,the company borrowed $34,000 on a new Long-Term Note Payable

There were no stock retirements during the year.

There were no sales of treasury stock during the year.

All sales are on credit.

Prepare a complete statement of cash flows using the indirect method.

Definitions:

Y-Intercept

The y-intercept of a line or curve on a graph is the point at which it crosses the y-axis, indicating the value of the dependent variable when all independent variables are zero.

Slope

In the context of linear regression, the slope indicates the change in the dependent variable for each unit change in the independent variable.

Least Squares Regression Line

A straight line that best fits the data according to the method of least squares, minimizing the sum of the squares of the differences between observed and predicted values.

Actual Value

The true value of a parameter or measurement, often unknown in practice and estimated from data.

Q18: Aaron Inc.estimates direct labor costs and manufacturing

Q32: Which of the following best describes horizontal

Q37: The three sections of the statement of

Q71: In a vertical analysis of the balance

Q78: The income statement is also known as

Q98: If a bond's stated interest rate is

Q100: Lawrence,an employee of Light Inc.,has gross salary

Q105: Avatar Company uses the indirect method to

Q129: Jezebel Inc.completed Job 12 and several other

Q140: Paid-in capital is externally generated capital and