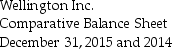

Wellington Company uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ended December 31,2015:

-On Wellington's statement of cash flows,using the direct method,what amount will be shown for total net cash flow from operating activities? (Assume Accrued Liabilities relate to Other Operating Expense.)

Definitions:

Qualified Education Loan

A loan taken out solely to pay qualified higher education expenses for the borrower, the borrower's spouse, or the borrower's dependent.

Qualified Education Expenses

Expenses required for enrollment or attendance at an educational institution, including tuition, fees, and course-related costs.

Taxpayer's Spouse

The legally married partner of a taxpayer, who may be considered for joint tax filing status and benefits.

Alimony Recapture Rules

Tax regulations designed to prevent excessive deductions for alimony payments, potentially requiring a payer to include in income previously deducted payments under certain conditions.

Q13: Merchandiser's inventory consists of raw materials inventory,work-in-process

Q25: Discount on Bonds Payable is considered to

Q27: With respect to direct materials,what is the

Q64: Free cash flow is calculated by adding

Q73: Blandings Glassware Company issues $1,000,000 of 8%,10-year

Q87: Discontinued operations and extraordinary items are reported

Q88: On January 1,2014,Zing Services issued $165,000 of

Q117: Given the following information,determine the cost of

Q127: Saturn Accounting Services expects its accountants to

Q128: The change in Inventory will be shown