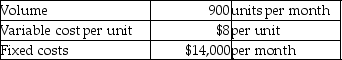

Cheong Automobiles Company fabricates inexpensive automobiles for sale to third world countries.Each vehicle includes one wiring harness,which is currently made in-house.Details of the harness fabrication are as follows:  A factory in Indonesia has offered to supply Cheong with ready-made units for a price of $14 per wiring harness.Assume that Cheong's fixed costs could be reduced by $5,000 if they outsource,and that Cheong will not be able to use the excess capacity in any profitable manner.What will be the impact Cheong's monthly operating income,if Cheong decides to outsource?

A factory in Indonesia has offered to supply Cheong with ready-made units for a price of $14 per wiring harness.Assume that Cheong's fixed costs could be reduced by $5,000 if they outsource,and that Cheong will not be able to use the excess capacity in any profitable manner.What will be the impact Cheong's monthly operating income,if Cheong decides to outsource?

Definitions:

Subchapter S

A section of the Internal Revenue Code that provides for a special tax status for qualifying small businesses, allowing income to be taxed at the shareholder level and not at the corporate level.

Net Capital Loss

This occurs when the total capital losses from investments exceed the total capital gains, which can sometimes be used to offset other types of income for tax purposes.

Ordinary Income

This refers to any income earned through work, interest, dividends, or rental income, subject to standard tax rates.

Dividend Income

Income received from owning shares in a company, paid out from the company's profits.

Q25: From the following particulars of Rose Mary

Q42: Fantabulous Products sells 2,000 kayaks per year

Q44: Jason has a loan that requires a

Q71: Calculate the target rate of return.<br>A)22%<br>B)25%<br>C)18%<br>D)15%

Q80: The company's management is considering dropping the

Q90: The company uses management by exception

Q93: What is the flexible budget variance

Q140: The fixed manufacturing costs increase by $100,000

Q148: Hilltop Golf Course is planning for the

Q161: Flexible budget variance is the difference between