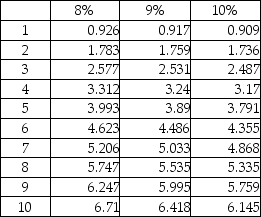

A company is considering an iron ore extraction project that requires an initial investment of $500,000 and will yield annual cash flows of $150,000 for 4 years.The company's hurdle rate is 9%.What is the NPV of the project?

Definitions:

Flooded

Describes areas that have been overwhelmed with water, often due to excessive rainfall, river overflow, or dam failure.

Terrace

A relatively level or gently inclined surface or bench bounded on one edge by a steeper descending slope.

Entrenched Meanders

Deeply incised meanders in a river or stream that retain their winding course because the land elevation change has been rapid compared to the lateral motion of the river.

Base Level

The lowest point to which a river or stream can erode its channel, often sea level for rivers.

Q6: Regardless of the system used in departmental

Q10: The transfer price is the transaction amount

Q24: The residual value is discounted as a

Q39: Return on Investment (ROI)measures the profitability of

Q47: An operational asset used for a long

Q65: In this chapter, you examined several short-term

Q106: Clapton Corporation is considering an investment in

Q108: Net present value and internal rate of

Q110: Assuming the Football Helmet line is

Q154: Good management accounting indicates that projects be