Rockaway Company produces two types of product, flat and round, on the same production line. For the current period, the company reports the following data.

Rockaway's controller wishes to apply activity-based costing (ABC) to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above. She has collected the following information.

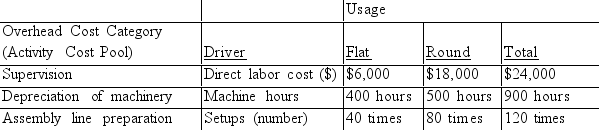

She has also collected the following information about the cost drivers for each category (cost pool) and the amount of each driver used by the two product lines.

Assign these three overhead cost pools to each of the two products using ABC. Show each overhead cost allocation by product and the total overhead allocated to each product. Determine average cost per unit for each of the two products using ABC. (Round your answer to 2 decimal places.) Which overhead cost allocation method would you recommend to the controller?

Assign these three overhead cost pools to each of the two products using ABC. Show each overhead cost allocation by product and the total overhead allocated to each product. Determine average cost per unit for each of the two products using ABC. (Round your answer to 2 decimal places.) Which overhead cost allocation method would you recommend to the controller?

Definitions:

Olfactory Neurons

Specialized nerve cells responsible for the sense of smell, located in the olfactory epithelium of the nasal cavity.

Mechanoreceptors

Sensory receptors that respond to mechanical pressures or distortions, such as touch, pressure, vibration, and sound.

Olfactory Epithelium

A specialized epithelial tissue inside the nasal cavity involved in the sense of smell, containing olfactory receptor cells.

Taste Buds

Sensory organs found on the tongue that are primarily involved in detecting tastes.

Q8: <br>The present value of an annuity of

Q18: When the amount invested differs substantially across

Q32: Healthier Living Company manufactures two products-toaster ovens

Q33: A company has two different products that

Q89: CM Manufacturing has provided the following unit

Q92: Rent and maintenance expenses would most likely

Q115: Landmark Prints Company is considering an investment

Q142: With respect to cycle time, companies strive

Q151: Allocating costs to service departments involves accumulating

Q167: Companies promoting continuous improvement strive to achieve