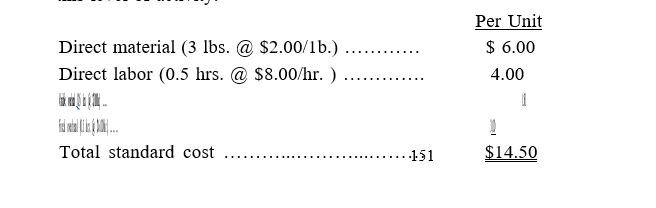

Gleason Company has developed the following standard cost data based on 60,000 direct labor hours, which is 75% of capacity. Fixed overhead is $360,000 and variable overhead is $180,000 at this level of activity.

During the current period, the company operated at 80% of capacity and produced 128,000 units. Actual costs were:

Calculate the variable overhead spending and efficiency variance and the fixed overhead spending

and volume variances. Indicate whether each is favorable or unfavorable.

Definitions:

Deadweight Loss

Economic efficiency loss occurring when free market equilibrium is not achieved for a good or service.

Revenues

The income generated from normal business operations and includes discounts and deductions for returned merchandise.

Tax

A financial charge or levy imposed by a government on individuals or entities to fund public expenditures, thereby shaping economic policies.

Laffer Curve

An illustration of the relationship between tax rates and tax revenue, suggesting there's an optimal tax rate that maximizes revenue.

Q3: The margin of safety can be expressed

Q9: A graphic depiction of the break-even point

Q21: Which of the following budgets is not

Q64: Ultimo Co. operates three production departments

Q115: For each of the capital budgeting methods

Q122: The master budgeting process typically begins with

Q139: Calculating return on investment for an investment

Q161: Flack Corporation, a merchandiser, provides the following

Q185: When preparing the cash budget, all of

Q199: The amount by which a department's sales