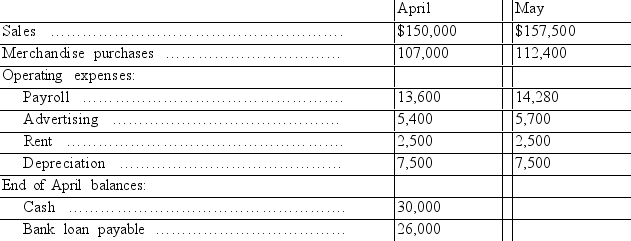

Todd Enterprises is preparing a cash budget for the second quarter of the coming year. The following data have been forecasted:

Additional data:

Additional data:

(1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and the balance paid in the following month.

(3) Operating expenses are paid in the month they are incurred.

(4) A minimum cash balance of $25,000 is required at the end of each month.

(5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made whenever excess cash is available.

Prepare the company's cash budget for May. Show the ending loan balance at May 31.

Definitions:

Tax Rate Structure

The method or system by which taxes are levied on income, goods, services, and properties, which can be progressive, regressive, or proportional.

Proportional

A tax structure where the rate remains constant regardless of income level.

Progressive Tax Structure

A tax system where the tax rate increases as the taxable amount increases, leading to higher earners paying a larger percentage of their income in taxes.

Marginal Rates

These are the tax rates that apply to each additional dollar of income, used in a progressive tax system where tax rates increase as income rises.

Q37: Compute the number of equivalent units with

Q38: The amount Webster must borrow during April

Q98: Since the process cost summary describes the

Q118: Fletcher Company collected the following data

Q134: At the beginning of the month, the

Q136: If Department R uses $60,000 of

Q148: If budgeted beginning inventory is $8,300, budgeted

Q159: The merchandise purchases budget is the starting

Q171: Based on this information, the direct materials

Q186: What is the budgeted materials need in