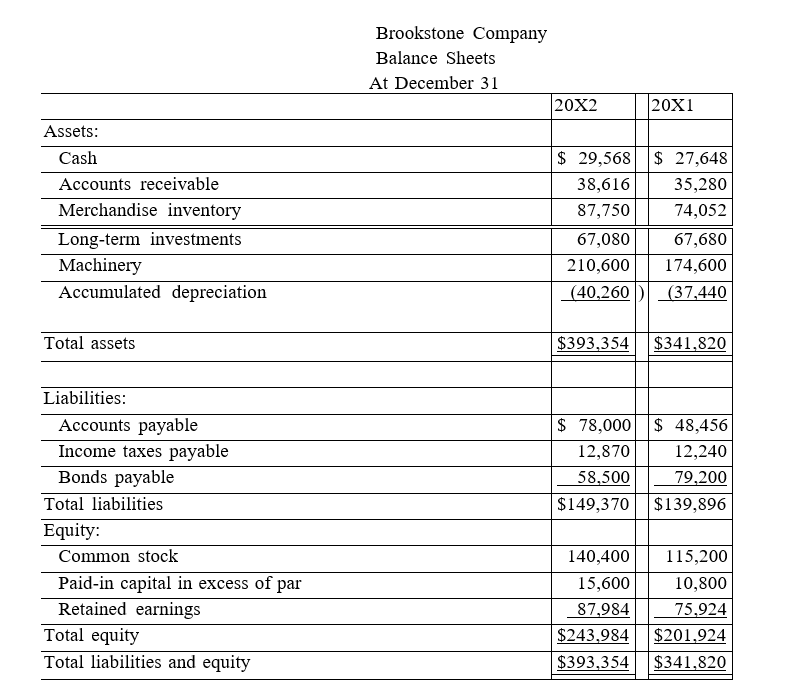

The following information is available for the Brookstone Company:

Brookstone Company Balance Sheets

At December 31

Brookstone Company Income Statement

Brookstone Company Income Statement

For Year Ended December 31, 20X2

Additional information:

(1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired.

(2) Old machinery with an original cost of $45,060 was sold for $2,520 cash.

(3) New machinery was purchased for $81,060 cash.

(4) Cash dividends of $40,320 were paid.

(5) Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for calendar-year 20X2 using the indirect method.

Definitions:

Bankrupt

A financial condition in which an individual or organization is unable to meet their debt obligations.

National Unemployment Rate

A measure of the percentage of the workforce that is not employed but is actively seeking employment within a country.

Democratic Primaries

A series of electoral events in which the Democratic Party's members vote to choose their candidates for various political offices.

Barack Obama

The 44th President of the United States, serving two terms from 2009 to 2017, and the first African American to hold the office.

Q13: Use the following information to calculate

Q42: Madison Corporation purchased 40% of Jay Corporation

Q53: The gain or loss from retirement of

Q74: Define the return on total assets and

Q108: Use the following information to calculate

Q113: Long-term investments in debt securities not classified

Q146: Northington, Inc. is preparing the company's

Q172: When applying equal total payments to a

Q200: Business activities that generate or use cash

Q233: Quick assets divided by current liabilities is