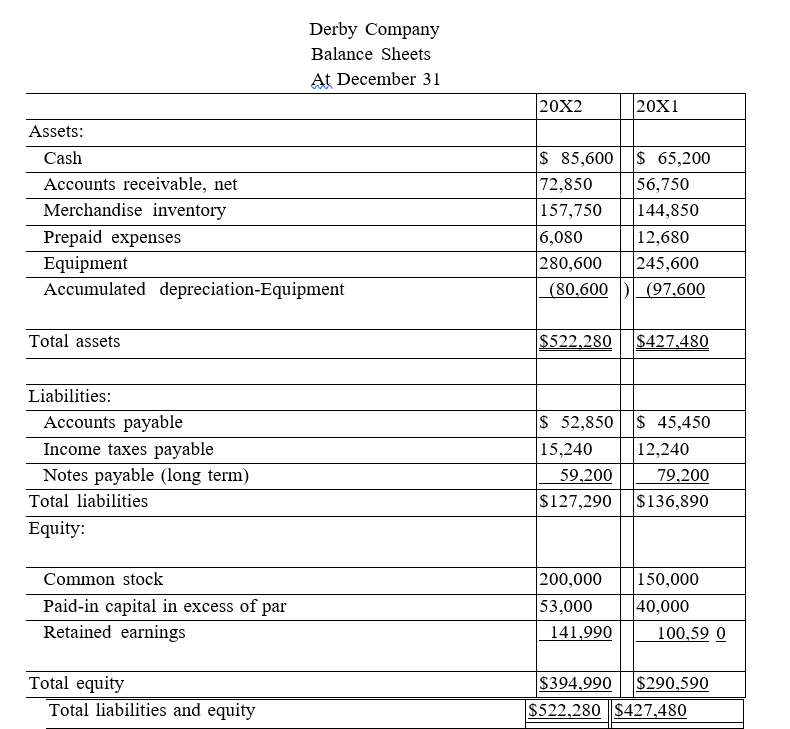

Use the following financial statements and additional information to (1) prepare a statement of cash flows for the year ended December 31, 20X2 using the indirect method, and (2) compute the company's cash flow on total assets ratio for 20X2. Derby Company Income Statement

Derby Company Income Statement

For Year Ended December 31, 20X2

Additional Information

a. A $20,000 note payable is retired at its carrying value in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid.

c. New equipment is acquired for $120,000 cash.

d. Received cash for the sale of equipment that had cost $85,000, yielding a gain of $4,700.

e. Prepaid expenses relate to Other Expenses on the income statement.

f. All purchases and sales of merchandise inventory are on credit.

Definitions:

Associative Learning

The process of learning in which a connection between two stimuli or between a stimulus and a response is learned.

Continuous Reinforcement

A learning process in which a behavior is reinforced every time it occurs, leading to faster acquisition of the behavior.

Respondent Behavior

A type of reaction to stimuli that is automatic or reflexive, such as salivating when smelling food.

Adaptive Learning

A teaching method that uses technology and algorithms to customize learning materials and activities to the needs of individual learners.

Q7: Element Company had the following long-term

Q62: Use the information provided to calculate

Q70: Match each of the following terms with

Q104: Sharmer Company issues 5%, 5-year bonds

Q119: A corporation borrowed $125,000 cash by signing

Q139: The purpose of managerial accounting information is

Q149: A company made an error in recording

Q165: The market price of Horokhiv Corporation's common

Q227: Return on equity increases when the expected

Q234: Financing activities include receiving cash dividends from