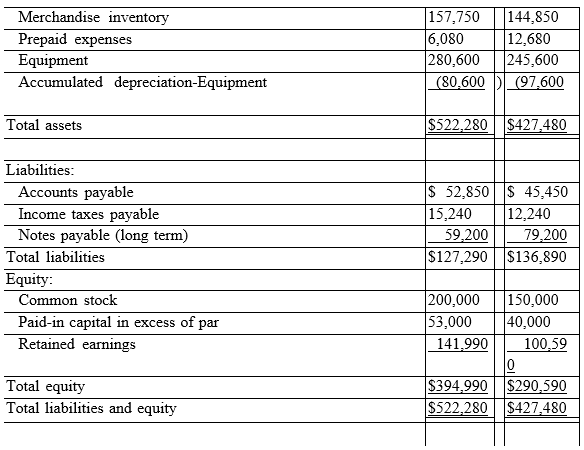

Use the following financial statements and additional information to (1) prepare a complete statement of cash flows for the year ended December 31, 20X2. The cash provided or used by operating activities should be reported using the direct method, and (2) compute the company's cash flow on total assets ratio for 20X2.

Additional Information

a.A $20,000 note payable is retired at its carrying value in exchange for cash.

b.The only changes affecting retained earnings are net income and cash dividends paid.

c.New equipment is acquired for $120,000 cash.

d.Received cash for the sale of equipment that had cost $85,000, yielding a gain of $4,700.

e.Prepaid expenses relate to Other Expenses on the income statement.

f.All purchases and sales of merchandise inventory are on credit.

Definitions:

Traumatic Events

Incidents that cause psychological, physical, emotional, or spiritual distress, often leading to lasting impacts on an individual's well-being and mental health.

Acute Stress Disorder

A mental health condition characterized by severe stress and anxiety symptoms that occur immediately after a traumatic event, lasting from three days to one month.

Intense Feelings

Strong emotional experiences that can be overwhelming and deeply affect a person's state of mind and well-being.

Affective Arousal

A state of emotional stimulation or intensity, which can influence mood, perception, and behavior.

Q90: Scotsland Company had the following transactions relating

Q90: A company borrowed $40,000 cash from the

Q92: A company had average total assets of

Q92: Waters, Inc. reported the following data regarding

Q102: The legal document identifying the rights and

Q139: Use the following information to calculate cash

Q167: On January 1, a company issued a

Q175: Marshall Company sold supplies in the amount

Q201: Held-to-maturity securities are:<br>A) Always classified as Short-Term

Q202: Explain how transactions (both sales and purchases)