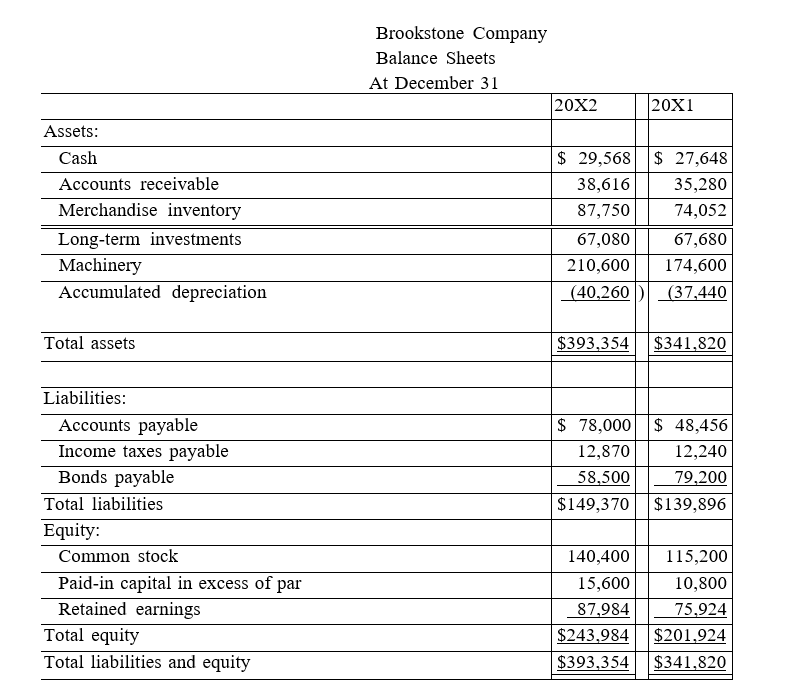

The following information is available for the Brookstone Company:

Brookstone Company Balance Sheets

At December 31

Brookstone Company Income Statement

Brookstone Company Income Statement

For Year Ended December 31, 20X2

Additional information:

(1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired.

(2) Old machinery with an original cost of $45,060 was sold for $2,520 cash.

(3) New machinery was purchased for $81,060 cash.

(4) Cash dividends of $40,320 were paid.

(5) Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for calendar-year 20X2 using the indirect method.

Definitions:

Late Assignments

Assignments submitted after the deadline.

Annual Income

The total amount of income earned over a year before taxes and other deductions.

Square Foot

A unit of area measurement equal to a square measuring one foot on each side.

Family Size

The number of individuals in a household, encompassing all related and unrelated members.

Q8: Chang Industries has bonds outstanding with a

Q15: What amount of interest expense will

Q18: Crane, Inc. reported the following data regarding

Q51: The current ratio is:<br>A) 0.7:1.<br>B) 1:1.<br>C)

Q69: A decrease in the fair value of

Q74: Liquidity and efficiency are the ability to

Q106: The carrying value of a long-term note

Q180: A company's board of directors analyzes financial

Q187: A statement of cash flows explains the

Q243: An employee devises a payroll scheme that