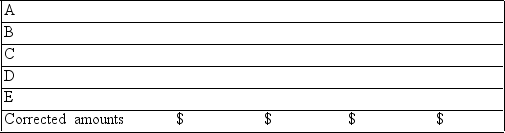

A company issued financial statements for the year ended December 31, but failed to include the following adjusting entries:

A. Accrued interest revenue earned of $1,200.

B. Depreciation expense of $4,000.

C. Portion of prepaid insurance expired (an asset) used $1,100.

D. Accrued taxes of $3,200.

E. Revenues of $5,200, originally recorded as unearned, have been earned by the end of the year. Determine the correct amounts for the December 31 financial statements by completing the following table:

Definitions:

Solvency

Indicates the ability of a company or individual to meet long-term financial obligations; solvency is crucial for staying operational and avoiding bankruptcy.

Liquidity

A measure of how easily assets can be converted into cash without significant loss in value.

Working Capital

This refers to the amount by which current assets exceed current liabilities, indicating the liquidity available to a business for day-to-day operations.

Current Liabilities

Short-term financial obligations that are due within one year or within the normal operating cycle of a business.

Q61: The calendar year-end adjusted trial balance

Q93: Owner withdrawals always decrease equity.

Q101: The length of time covered by a

Q123: Describe a work sheet and explain why

Q123: Morgan, Inc. uses a perpetual inventory

Q132: Under the _ inventory accounting system, each

Q142: All of the following regarding a Certified

Q187: A business's record of the increases and

Q196: The income statement describes revenues earned and

Q245: The accounting process begins with:<br>A) Analysis of