Based on the unadjusted trial balance for Glow Styling and the adjusting information given below, prepare the adjusting journal entries for Glow Styling. After completing the adjusting entries, prepare the trial balance for Glow Styling.

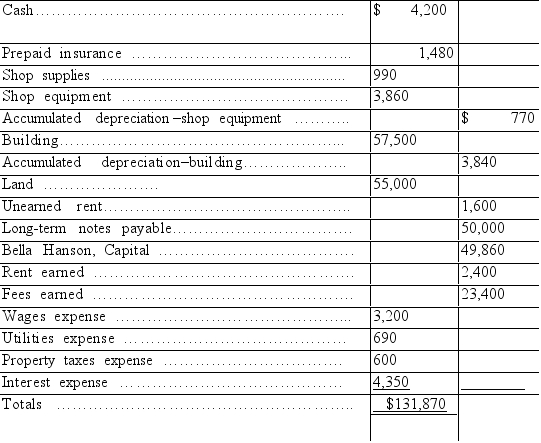

Glow Styling unadjusted trial balance for the current year follows:

Glow Styling Trial Balance December 31

$131,870

Additional information:

Additional information:

a. An insurance policy examination showed $1,240 of expired insurance.

b. An inventory count showed $210 of unused shop supplies still available.

c. Depreciation expense on shop equipment, $350.

d. Depreciation expense on the building, $2,220.

e. A beautician is behind on space rental payments, and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f. $800 of the Unearned Rent account balance was earned by year-end.

g. The one employee, a receptionist, works a five-day workweek at $50 per day. The employee was paid last week but has worked four days this week for which she has not been paid.

h. Three months' property taxes, totaling $450, have accrued. This additional amount of property taxes expense has not been recorded.

i. One month's interest on the note payable, $600, has accrued but is unrecorded.

Use the above information to prepare the adjusted trial balance for Glow Styling.

Definitions:

Disposable Income

Money that households can allocate towards savings and spending after income tax charges.

C + I

An economic term that represents the sum of consumer spending (C) and investment spending (I); key components of the Gross Domestic Product (GDP) formula.

Investment

The allocation of resources, such as capital or time, in the hope of generating future profits or benefits.

Capacity Utilization Rate

The percentage of a firm's total production capacity that is actually being used in production.

Q6: A company records the fees for legal

Q21: The broad principle that requires expenses to

Q27: Compute Chase Company's current ratio using

Q41: The approach to preparing financial statements based

Q90: A company made no adjusting entry for

Q117: The first section of the income statement

Q149: Which of the following is classified as

Q214: Withdrawals by the owner are a business

Q227: A business paid $100 cash to Charles

Q227: A balance sheet covers activities over a