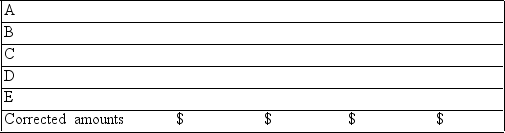

A company issued financial statements for the year ended December 31, but failed to include the following adjusting entries:

A. Accrued interest revenue earned of $1,200.

B. Depreciation expense of $4,000.

C. Portion of prepaid insurance expired (an asset) used $1,100.

D. Accrued taxes of $3,200.

E. Revenues of $5,200, originally recorded as unearned, have been earned by the end of the year. Determine the correct amounts for the December 31 financial statements by completing the following table:

Definitions:

Income Redistribution

A policy or process aimed at adjusting the distribution of income among a population to reduce inequality.

Economics

The social science concerned with the production, distribution, and consumption of goods and services, and the analysis of the choices people make to satisfy their needs.

Scarcity

The fundamental economic problem of having seemingly limitless human wants in a world with limited resources.

Government Intervention

Actions taken by a government to influence or regulate economic activities, often to correct market failures or achieve social goals.

Q2: <i>Financing activities</i> provide the means organizations use

Q28: The trial balance prepared after all closing

Q50: The assets of a company total $700,000;

Q103: If a prepaid expense account were not

Q118: What is a trial balance? What is

Q141: _is the process of transferring journal entry

Q152: All of the following are asset accounts

Q167: When a company has no reportable nonoperating

Q222: A bookkeeper has debited an asset account

Q284: An external transaction is an exchange within