Based on the unadjusted trial balance for Glow Styling and the adjusting information given below, prepare the adjusting journal entries for Glow Styling. After completing the adjusting entries, prepare the trial balance for Glow Styling.

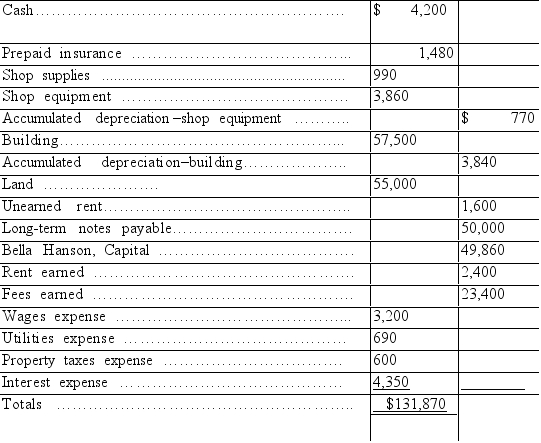

Glow Styling unadjusted trial balance for the current year follows:

Glow Styling Trial Balance December 31

$131,870

Additional information:

Additional information:

a. An insurance policy examination showed $1,240 of expired insurance.

b. An inventory count showed $210 of unused shop supplies still available.

c. Depreciation expense on shop equipment, $350.

d. Depreciation expense on the building, $2,220.

e. A beautician is behind on space rental payments, and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f. $800 of the Unearned Rent account balance was earned by year-end.

g. The one employee, a receptionist, works a five-day workweek at $50 per day. The employee was paid last week but has worked four days this week for which she has not been paid.

h. Three months' property taxes, totaling $450, have accrued. This additional amount of property taxes expense has not been recorded.

i. One month's interest on the note payable, $600, has accrued but is unrecorded.

Use the above information to prepare the adjusted trial balance for Glow Styling.

Definitions:

Response Times

The duration between the initiation of a query, command, or stimulus and the system's or person's reaction or reply.

Nonparametric Procedure

A nonparametric procedure refers to a type of statistical analysis that does not rely on data belonging to any particular distribution, suitable for ordinal data or when the data's distribution is unknown.

Kruskal-Wallis Test

An analytical method not predicated on parameters for assessing statistically significant disparities among two or more groups related to an independent variable in relation to a dependent variable that is either continuous or ordinal.

Kruskal-Wallis Test

A nonparametric method for testing whether samples originate from the same distribution, used for comparing more than two samples that are independent.

Q15: If a company is highly leveraged, this

Q45: External users include lenders, shareholders, customers, and

Q67: Accounts that appear in the balance sheet

Q83: If a company mistakenly forgot to record

Q90: A company made no adjusting entry for

Q93: The time period assumption assumes that an

Q97: A company pays its employees $4,000 each

Q107: The current portion of long-term debt is

Q186: Since the revenue recognition principle requires that

Q191: If the liabilities of a business increased