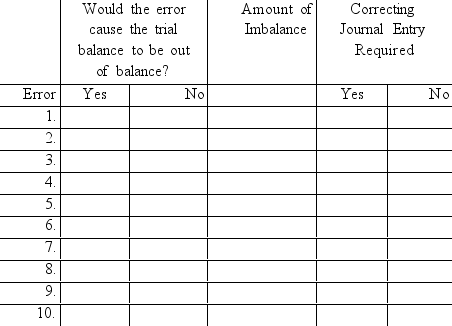

At year-end, Henry Laundry Service noted the following errors in its trial balance:

1. It understated the total debits to the Cash account by $500 when computing the account balance.

2. A credit sale for $311 was recorded as a credit to the revenue account, but the offsetting debit was not posted.

3. A cash payment to a creditor for $2,600 was never recorded.

4. The $680 balance of the Prepaid Insurance account was listed in the credit column of the trial

128

balance.

5. A $24,900 van purchase was recorded as a $24,090 debit to Equipment and a $24,090 credit to Notes Payable.

6. A purchase of office supplies for $150 was recorded as a debit to Office Equipment. The offsetting credit entry was correct.

7. An additional investment of $4,000 by Del Henry was recorded as a debit to Del Henry, Capital and as a credit to Cash.

8. The cash payment of the $510 utility bill for December was recorded (but not paid) twice.

9. The revenue account balance of $79,817 was listed on the trial balance as $97,817.

10. A $1,000 cash withdrawal was recorded as a $100 debit to Del Henry, Withdrawal and $100 credit to cash.

Using the form below, indicate whether each error would cause the trial balance to be out of balance, the amount of any imbalance, and whether a correcting journal entry is required.

Definitions:

360-Degree Feedback

A feedback process where employees receive confidential, anonymous feedback from the people who work around them, including peers, subordinates, and supervisors.

Democratic Management Style

A management approach characterized by involving employees in decision-making processes, thus promoting workplace democracy.

Experiencing Flow

A mental state of complete immersion and involvement in an activity, where time seems to pass unnoticed, and the individual experiences enjoyment and intrinsic motivation.

Task Leadership

The ability to guide, organize, and execute tasks and projects in a leadership context, focusing on achieving objectives.

Q17: The calendar year-end adjusted trial balance for

Q92: If the basis of a partnership interest

Q112: The accrual basis of accounting:<br>A) Recognizes expenses

Q130: Tax rates are progressive.

Q138: Skinner Corporation, a calendar year C corporation,

Q169: A company's ledger is:<br>A) A list of

Q185: Murrelet Corporation is a calendar year taxpayer

Q190: Depreciation measures the decline in market value

Q236: A company borrows $125,000 from the Northern

Q259: A net loss occurs when revenues exceed