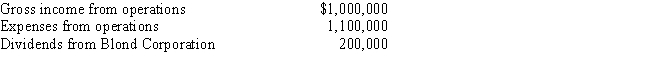

In the current year, Auburn Corporation (a calendar year taxpayer) , has the following income and expenses:

Auburn Corporation owns 20% of the stock in Blond Corporation. The dividends received deduction for the current year is:

Auburn Corporation owns 20% of the stock in Blond Corporation. The dividends received deduction for the current year is:

Definitions:

Interest Rates

The cost of borrowing money, typically expressed as a percentage of the amount borrowed, that lenders charge borrowers.

Classical Economists

Economists from the 18th and 19th centuries who believed in self-regulating markets and emphasized the importance of supply in determining economic value.

Money

A medium of exchange that facilitates trade, and is widely accepted in payment for goods and services and repayment of debts.

Savings

The portion of income not spent on consumption, often set aside for future use or investment.

Q18: A personal use property casualty loss is

Q58: Operating activities include long-term borrowing and repaying

Q66: Under what circumstances is it advantageous for

Q79: As of January 1, 2017, Crimson Corporation,

Q96: Purple Corporation, a personal service corporation (PSC),

Q98: A partner's basis in the partnership interest

Q120: Technology:<br>A) Reduces the time, effort and cost

Q144: At the end of the current year,

Q153: If the assets of a company increase

Q224: Explain the debt ratio and its use