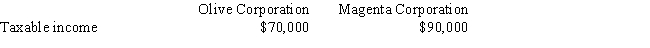

Two unrelated, calendar year C corporations have the following taxable income for the current year:  Magenta Corporation is a qualified personal service corporation. Based on these facts, their corporate tax liability is:

Magenta Corporation is a qualified personal service corporation. Based on these facts, their corporate tax liability is:

Definitions:

Coping Mechanisms

Coping Mechanisms are the strategies individuals use to manage stressful situations or emotional difficulties, which can be either adaptive or maladaptive.

Eating Disorders

Disorders characterized by abnormal or disturbed eating habits, which negatively impact one's health and daily functioning.

African American Women

Refers to women of African descent living in the United States, often highlighting their unique cultural, social, and historical experiences.

Non-Hispanic White

A demographic category used in the United States for people who identify as white and are not of Hispanic or Latino origin.

Q4: In the partnership form of business, the

Q8: A corporation's election to forego a net

Q11: Ramon is in the business of buying

Q44: Spencer has an investment in two parcels

Q49: A defined contribution plan is exempt from

Q61: A $130 credit to Supplies was credited

Q100: Distributions of cash or other resources by

Q103: Assets are the resources a company owns

Q109: Opportunities in accounting include auditing, consulting, market

Q268: Which of the following accounts is not