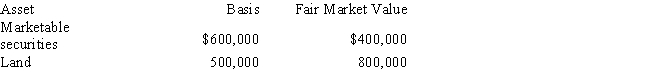

Arthur forms Catbird Corporation with the following investment:

Arthur receives all of the stock of Catbird.

Arthur receives all of the stock of Catbird.

a.What is Arthur's basis in the Catbird Corporation stock?

b.What is Catbird Corporation's basis in the marketable securities? The land?

Definitions:

Given Unit

A specific quantity or measure that serves as a standard or reference for tasks or calculations in various contexts.

Cash Discount

is a reduction in the invoice amount offered to purchasers as an incentive for early payment, improving cash flow.

Interest Rate

The percentage at which interest is paid by a borrower for the use of money that they borrow from a lender.

Gross Amount

The total sum before any deductions are made, such as taxes, discounts, or expenses.

Q6: Roxy, Inc., grants 1,000 NQSO to an

Q30: Pony, Inc., issues restricted stock to employees

Q41: Darlene, a 30% shareholder in a calendar

Q87: Rico's Taqueria had cash inflows from operating

Q104: List the four steps in recording transactions.

Q116: Tax-exempt income received by the corporation will

Q130: Tax rates are progressive.

Q146: <br>If Jerry made no investments in the

Q149: Joel Consulting received $3,000 from a customer

Q227: A business paid $100 cash to Charles