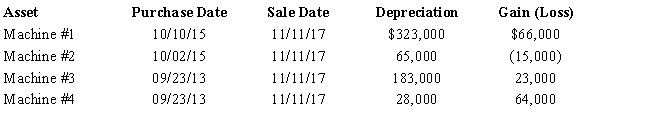

A business taxpayer sold all the depreciable assets of the business, calculated the gains and losses, and would like to know the final character of those gains and losses. The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets. The taxpayer had unrecaptured § 1231 lookback loss of $12,000. What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

Definitions:

India

A country in South Asia, known for its diverse culture, historical landmarks, and rapidly growing economy.

Lifestyle Entrepreneur

Person who starts a business to reduce work hours and create a more relaxed lifestyle.

Serial Entrepreneur

An individual who repeatedly starts new businesses, taking on the risks and rewards of multiple ventures.

Intrapreneur

An employee within a company who promotes innovative product development and marketing by acting as an entrepreneur.

Q4: Jamie is terminally ill and does not

Q16: Involuntary conversion gains may be deferred if

Q23: The tax law requires that capital gains

Q44: What causes a partner's basis in a

Q58: For § 1245 recapture to apply, accelerated

Q61: Yard Corporation, a cash basis taxpayer, received

Q87: Joey has been an active participant in

Q129: Taxpayers who want both limited liability and

Q182: A common characteristic of _ is their

Q196: Excess capital losses can be carried over