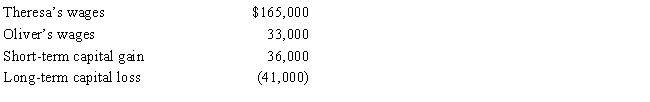

Theresa and Oliver, married filing jointly, and both over 65 years of age, have no dependents. Their 2017 income tax facts are:

What is their taxable income for 2017?

Definitions:

Functions

Specific roles or activities that are natural to an object or person, or assigned tasks meant to be performed.

Health Benefits

refer to the positive impacts on one's physical and mental well-being, often resulting from healthy lifestyle choices, medical treatments, or preventive measures.

Sexual Activity

Behaviors that include a wide range of activities, from kissing and touching to sexual intercourse, involving one or more persons.

Hooking Up

A term used to describe a variety of sexual behaviors between individuals who are not in a committed relationship, often implying casual sexual encounters.

Q16: The basis of boot received in a

Q23: If the regular income tax deduction for

Q29: Estimated tax payments may have to be

Q46: Katie sells her personal use automobile for

Q49: Taylor sold a capital asset on the

Q51: In 2006, a medical doctor who incorporated

Q79: Explain how the sale of investment property

Q91: The adjusted basis for a taxable bond

Q94: Jean is a shareholder in Parrot Corporation,

Q105: Morgan owned a convertible that he had