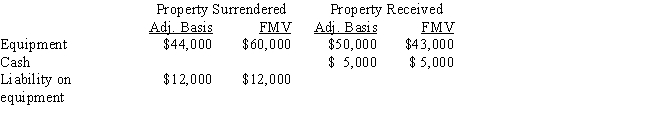

Sammy exchanges equipment used in his business in a like-kind exchange. The property exchanged is as follows:

The other party assumes the liability.

a.What is Sammy's recognized gain or loss?

b.What is Sammy's basis for the assets he received?

Definitions:

Special Relationship

A legal concept denoting a duty of care that exists between parties, beyond general public duty.

Reporting Issuer

A company whose securities are traded on a stock exchange and must regularly disclose financial and other significant information.

Shares

Units of ownership interest in a corporation or financial asset, providing an equitable distribution of profits, if any, in the form of dividends.

Takeover Bids

Proposals or offers made by one company to purchase a controlling stake in another company.

Q3: The installment method can be used for

Q51: Jack and Jill are married, have three

Q76: Sandra's automobile, which is used exclusively in

Q78: Which of the following statements is incorrect?<br>A)

Q85: For a taxpayer who is required to

Q95: What is the difference between the depreciation

Q101: A realized gain whose recognition is postponed

Q104: Molly has generated general business credits over

Q118: Capital recoveries include:<br>A)The cost of capital improvements.<br>B)Ordinary

Q126: Which of the following statements is correct