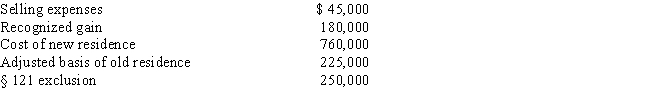

Use the following data to determine the sales price of Etta's principal residence and the realized gain. She is not married. The sale of the old residence qualifies for the § 121 exclusion.

Definitions:

Risk-neutral

An attitude towards risk where an individual values all outcomes equally without preference for risk.

Risk-loving

A preference or inclination to undertake investment with uncertain outcomes, often with the potential for significant gains.

Utility

A measure of satisfaction, usefulness, or value that a consumer derives from consuming a good or service.

Decreasing Rate

A situation or condition in which the rate at which something occurs or is processed diminishes over time.

Q2: Ashby, who is single and age 30,

Q18: Cole exchanges an asset (adjusted basis of

Q21: If a NQSO has a readily ascertainable

Q41: In 2017, Swan Company discovered that it

Q48: Karen owns City of Richmond bonds with

Q60: Tan, Inc., sold a forklift on April

Q71: If a company uses the LIFO inventory

Q76: Louis owns a condominium in New Orleans

Q135: Jacob owns land with an adjusted basis

Q146: Kelly inherits land which had a basis