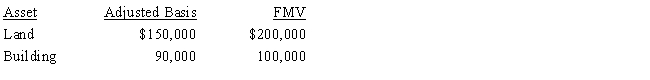

On September 18, 2017, Jerry received land and a building from Ted as a gift. Ted had purchased the land and building on March 5, 2014, and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid no gift tax on the transfer to Jerry.

a.Determine Jerry's adjusted basis and holding period for the land and building.

b.Assume instead that the FMV of the land was $89,000 and the FMV of the building was $60,000. Determine Jerry's adjusted basis and holding period for the land and building.

Definitions:

Single Frequency

A wave or signal characterized by one specific frequency, often used in the context of radio, sound, or light waves.

Prosody

The aspect of speech that involves rhythm, stress, and intonation patterns, contributing to the conveyance of meaning and emotion in spoken language.

Tone Of Voice

The vocal quality, pitch, and emotion used during conversation that affects the meaning of the message.

Tinnitus

A common condition involving the perception of noise or ringing in the ears, which is not caused by an external sound.

Q7: Which of the following types of exchanges

Q12: Rick, a computer consultant, owns a separate

Q22: The basis for gain and loss of

Q36: Judy owns a 20% interest in a

Q58: Nell records a personal casualty loss deduction

Q69: Joseph and Sandra, married taxpayers, took out

Q74: If a taxpayer is required to recapture

Q77: Beige, Inc., records AMTI of $200,000. Calculate

Q111: Dabney and Nancy are married, both gainfully

Q111: Byron, who lived in New Hampshire, acquired