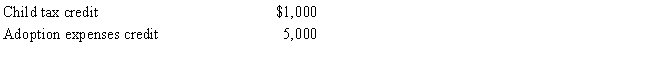

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000. and his tentative minimum tax is $195,000. Justin reports the following credits.  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

Definitions:

Psychologists

Professionals specializing in the science of behavior and mind, embracing all aspects of conscious and unconscious experience as well as thought.

Basic Emotions

Fundamental emotions that are hard-wired in humans since birth and universally recognized, including joy, surprise, sadness, anger, fear, and disgust.

Psychologists

Professionals who study mental processes and behavior by observing, interpreting, and recording how people relate to one another and to their environments.

Cultural Variations

Differences in practices, beliefs, and values among cultures, affecting behaviors, traditions, and ways of life.

Q3: Discuss the relationship between the postponement of

Q8: On February 1, 2017, Omar acquires used

Q18: Cole exchanges an asset (adjusted basis of

Q37: Jackson Company incurs a $50,000 loss on

Q73: Faith just graduated from college and she

Q76: Sandra's automobile, which is used exclusively in

Q96: Discuss the logic for mandatory deferral of

Q117: The exchange of unimproved real property located

Q127: What is the relationship between taxable income

Q156: One indicia of independent contractor (rather than