Essay

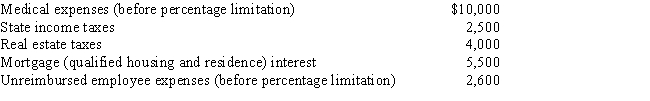

Cindy, who is single and age 48, has no dependents and has adjusted gross income of $50,000 in 2017. Her potential itemized deductions are as follows.

What are Cindy's AMT adjustments for itemized deductions for 2017?

What are Cindy's AMT adjustments for itemized deductions for 2017?

Explain the concept of excess capacity in monopolistically competitive firms.

Analyze the elasticity of demand for monopolistic competitors and understand the factors that determine it.

Describe the Herfindahl index and its calculation method.

Discuss the implications of product variety in monopolistic competition.

Definitions:

Related Questions

Q10: Eunice Jean exchanges land held for investment

Q32: During 2017, Kathy, who is self-employed, paid

Q37: The components of the general business credit

Q79: The work opportunity tax credit is available

Q91: The adjusted basis for a taxable bond

Q109: Summer Corporation's business is international in scope

Q112: Nick Lee is a linebacker for the

Q120: If Abby's alternative minimum taxable income exceeds

Q121: Tired of renting, Dr. Smith buys the

Q123: Which of the following is incorrect?<br>A) The