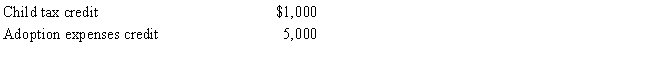

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000. and his tentative minimum tax is $195,000. Justin reports the following credits.  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

Definitions:

Charles Handy

An Irish author and philosopher specializing in organizational behavior and management who is known for his theories on the changing shape of work and organizations.

Traditional Career Path

A linear progression in one's professional life, typically involving successive roles within the same field or industry.

Core Worker

An employee who is considered essential to the operations of a business, often providing critical skills or functions.

Charles Handy

A respected British management thinker known for his theories on organizational culture and motivation.

Q15: Lindsey, an attorney, earns $125,000 from her

Q31: Cutback adjustment applies

Q52: Ronaldo contributed stock worth $12,000 to the

Q54: Madison is an instructor of fine arts

Q64: Dennis, a calendar year taxpayer, owns a

Q85: Nondeductible moving expense

Q89: Which of the following best describes the

Q96: Chris receives a gift of a passive

Q118: Bradley has two college-age children, Clint, a

Q123: Which of the following is incorrect?<br>A) The