Essay

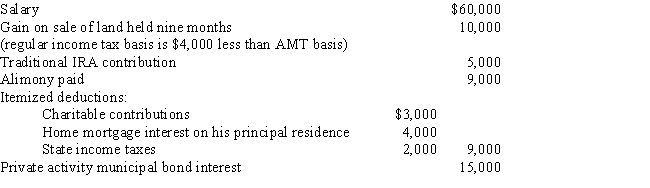

Gunter, who is divorced, reports the following items for 2017. Calculate Gunter's 2017 AMTI.

Definitions:

Related Questions

Q7: Which of the following types of exchanges

Q15: A taxpayer may qualify for the credit

Q23: Maria, who owns a 50% interest in

Q78: Ahmad owns four activities. He participated for

Q88: The carryover basis to a donee for

Q103: In computing the foreign tax credit, the

Q109: Which of the following factors should be

Q123: Discuss the application of holding period rules

Q132: An education expense deduction may be allowed

Q176: If a taxpayer does not own a