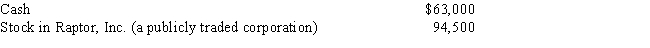

During the current year, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) : Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for the year is $189,000. What is Ralph's charitable contribution deduction for the current year?

Definitions:

Tax-Oriented Lease

A leasing arrangement designed to maximize tax benefits for the lessor, who retains ownership of the asset for tax purposes.

Leveraged Lease

A financing arrangement where a lessor uses borrowed funds to purchase an asset that is then leased to a third party.

Tax-Oriented

Refers to financial strategies or decisions that are primarily influenced by tax considerations.

Q9: Both education tax credits are available for

Q27: Arlene, who is single, reports taxable income

Q40: Paul and Patty Black (both are age

Q44: Juan, married and filing jointly, had the

Q57: The maximum cost recovery method for all

Q69: Sherri owns an interest in a business

Q69: Which of the following can be claimed

Q79: In 2016, Sarah (who files as single)

Q122: If personal casualty gains exceed personal casualty

Q158: At age 65, Camilla retires from her