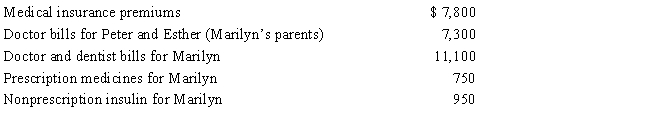

Marilyn, age 38, is employed as an architect. For calendar year 2017, she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them. Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2017 and received the reimbursement in January 2018. What is Marilyn's maximum allowable medical expense deduction for 2017?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them. Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2017 and received the reimbursement in January 2018. What is Marilyn's maximum allowable medical expense deduction for 2017?

Definitions:

Quality

The standard of something as measured against other things of a similar kind; the degree of excellence of something.

Wear Out

The process by which goods and materials deteriorate in quality and functionality over time due to use.

Expected Utility Function

A concept in economics that calculates the anticipated utility or satisfaction a consumer can derive from various options, considering the probabilities of different outcomes.

Sure Payment

A guaranteed financial transaction where the payer is certain to provide the agreed-upon sum to the payee.

Q20: Taxpayers may elect to use the straight-line

Q23: What is the easiest way for a

Q35: For all of the current year, Randy

Q40: Cardinal Corporation hires two persons certified to

Q74: Wes's at-risk amount in a passive activity

Q78: Which of the following statements is incorrect?<br>A)

Q90: A loss is not allowed for a

Q105: For regular income tax purposes, Yolanda, who

Q113: Maria, who is single, had the following

Q131: Sue files a Schedule SE with her