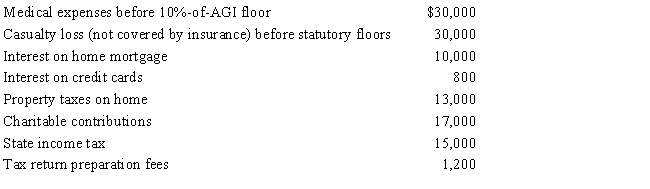

For calendar year 2017, Jon and Betty Hansen (ages 59 and 60) file a joint return reflecting AGI of $280,000. They incur the following expenditures:

What is the amount of itemized deductions the Hansens may claim?

Definitions:

Basic Human Need

Fundamental requirements necessary for individuals to survive and thrive, including food, water, shelter, and social interaction.

Action Identification Theory

A theory that describes how people understand and perceive their actions; it looks at how individuals identify and frame their actions based on their motivations and goals.

Completing a Task

The act of finishing a specific activity or assignment that was begun.

More Concrete

Pertains to being specific, tangible, and detailed, often referring to ideas or concepts that are clearly defined and observable.

Q9: Which of the following statements regarding differences

Q21: If the cost of a building constructed

Q22: On July 15, 2017, Mavis paid $275,000

Q31: On October 2, Ross quits his job

Q71: The phaseout of the AMT exemption amount

Q78: Which of the following statements is incorrect?<br>A)

Q79: In 2016, Sarah (who files as single)

Q92: For purposes of computing the credit for

Q94: James purchased a new business asset (three-year

Q116: If an account receivable written off during