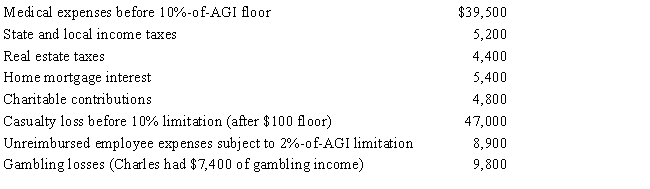

Charles, who is single and age 61, had AGI of $400,000 during 2017. He incurred the following expenses and losses during the year.

Compute Charles's total itemized deductions for the year.

Definitions:

Business Together

Collaborating or partnering with other businesses or individuals for mutual benefit and to achieve common goals.

Personal Life

The aspect of an individual's existence that involves personal relationships, family, interests, and activities outside of their professional occupation.

Heroes, Rulers

Distinguished or exemplary figures, often from history or literature, known for their leadership, bravery, or moral virtues.

Progressives, Traditionalists

Terms often used to describe groups or individuals with forward-looking, change-embracing ideas (progressives) versus those who prefer established, conventional methods (traditionalists).

Q3: In January 2017, Tammy acquired an office

Q16: In November 2017, Katie incurs unreimbursed moving

Q26: If startup expenses total $53,000, $51,000 of

Q37: If a vacation home is rented for

Q42: If more than 40% of the value

Q62: The AMT exemption for a C corporation

Q73: Al, who is single, has a gain

Q97: The amount of a loss on insured

Q106: Your friend Scotty informs you that he

Q177: For tax year 2016, Taylor used the