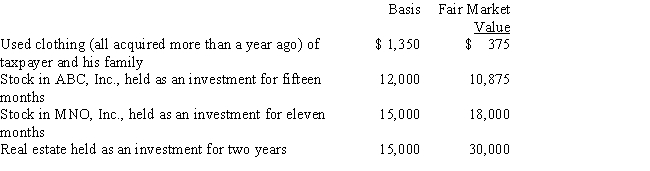

Zeke made the following donations to qualified charitable organizations during the year:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

Definitions:

Diffusion of Innovation

A theory that explains how, why, and at what rate new ideas and technology spread through cultures.

Daily Specials

Unique or discounted items or services offered on a particular day, often used by restaurants or retailers to attract more customers or promote certain products.

Innovators

Those buyers who want to be the first to have the new product or service.

Mammography Equipment

A specialized form of imaging equipment used to examine the breast tissue for signs of cancer or other abnormalities.

Q6: In 2017, Joanne invested $90,000 for a

Q25: Maurice sells his personal use automobile at

Q41: The IRS will issue advanced rulings as

Q41: For a new car that is used

Q42: John owns and operates a real estate

Q44: The § 179 deduction can exceed $510,000

Q58: How is qualified production activities income (QPAI)

Q62: How is the donee's basis calculated for

Q62: The amortization period for $58,000 of startup

Q139: Ken is considering two options for selling