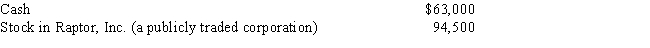

During the current year, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) : Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for the year is $189,000. What is Ralph's charitable contribution deduction for the current year?

Definitions:

Q10: Jake performs services for Maude. If Maude

Q10: Identify the types of income that are

Q17: If the AMT base is greater than

Q29: For purposes of the § 267 loss

Q43: During the current year, Ethan performs personal

Q50: A taxpayer is considered to be a

Q75: Last year, taxpayer had a $10,000 nonbusiness

Q84: On January 15 of the current taxable

Q85: Dan contributed stock worth $16,000 to his

Q90: Judy incurred $58,500 of interest expense this