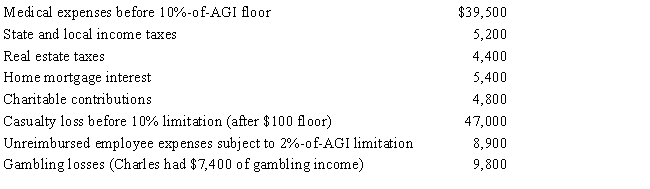

Charles, who is single and age 61, had AGI of $400,000 during 2017. He incurred the following expenses and losses during the year.

Compute Charles's total itemized deductions for the year.

Definitions:

Income Taxes

Taxes imposed by the government on income generated by businesses and individuals within their jurisdiction.

Net Present Value

A financial metric that calculates the difference between the present value of cash inflows and outflows over a period of time.

Required Rate of Return

The minimum return an investor expects to achieve by investing in a particular asset, considering its risk level.

Net Present Value

A financial metric that estimates the profitability of an investment or project by calculating the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Q3: When contributions are made to a traditional

Q5: The maximum child tax credit under current

Q44: The disabled access credit was enacted to

Q46: Barry and Larry, who are brothers, are

Q72: Purchased goodwill must be capitalized, but can

Q79: Residential rental real estate includes property where

Q112: Nick Lee is a linebacker for the

Q131: Sue files a Schedule SE with her

Q161: If the cost of uniforms is deductible,

Q169: In connection with the office in the