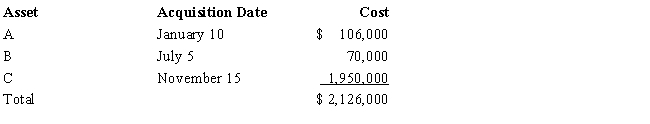

Audra acquires the following new five-year class property in 2017:

Audra elects § 179 treatment for Asset C. Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra claims the full available additional first-year depreciation deduction. Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Definitions:

Leaking Air Hose

A condition where an air hose has developed breaches, resulting in the unintended escape of air, potentially affecting the performance of pneumatic systems.

COE Truck Chassis

A type of truck design where the cab is situated over the engine, offering better visibility and maneuverability.

Gear Shift Lever

The component in a vehicle that the driver uses to select gears manually in a transmission system.

Q23: Maria, who owns a 50% interest in

Q28: Barney is a full-time graduate student at

Q52: Gull Corporation was undergoing reorganization under the

Q58: Kelly, who earns a yearly salary of

Q62: Alma is in the business of dairy

Q65: In 2018, Rhonda received an insurance reimbursement

Q66: Active participation.

Q68: Melody works for a company with only

Q78: Sue files a Form 2106 with her

Q80: The current position of the IRS is