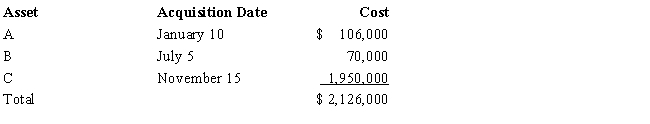

Audra acquires the following new five-year class property in 2017:

Audra elects § 179 treatment for Asset C. Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra claims the full available additional first-year depreciation deduction. Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Definitions:

Ammonia

A colorless gas with a pungent smell, composed of nitrogen and hydrogen (NH3), used in various industrial processes.

2-Bromo-2-Methylbutane

An organic compound known as a halogenated hydrocarbon, characterized by a bromine atom attached to the second carbon of a 2-methylbutane molecule.

Nucleophilic Substitution

A class of chemical reactions in which an electron-rich nucleophile selectively attacks an electron-deficient site on a molecule, displacing a leaving group.

Chloropyridines

Organic compounds consisting of a pyridine ring substituted with one or more chlorine atoms.

Q2: Tonya is a cash basis taxpayer. In

Q13: Alicia was involved in an automobile accident

Q40: John told his nephew, Steve, "if you

Q56: Trent sells his personal residence to Chester

Q70: The Blue Utilities Company paid Sue $2,000

Q74: As to meeting the time test for

Q86: The basis of cost recovery property must

Q89: Tom participates for 100 hours in Activity

Q94: James purchased a new business asset (three-year

Q96: Chris receives a gift of a passive