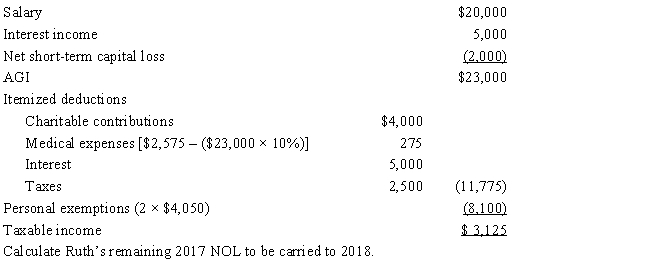

Ruth, age 66, sustains a net operating loss (NOL) of $15,000 for 2017. Because Ruth had no taxable income in 2015, the loss is carried back to 2016. For 2016, the joint income tax return of Ruth and her husband was as follows:

Definitions:

Target Company

A business entity identified as a potential acquisition or partnership candidate by another company or investor.

Verbal Pauses

Breaks in speech that are often used to gather thoughts or to emphasize a point.

Personal Information

Data relating to an individual, including details such as name, address, and contact information, that can be used to identify them.

Position

A standpoint or perspective adopted by an individual or group, often influenced by opinions or beliefs on a particular issue.

Q13: Alicia was involved in an automobile accident

Q26: Pedro's child attends a school operated by

Q31: Cutback adjustment applies

Q34: Rustin bought used 7-year class property on

Q36: Two years ago, Gina loaned Tom $50,000.

Q59: Tom, age 48, is advised by his

Q71: In Lawrence County, the real property tax

Q107: What are the three methods of handling

Q116: Which of the following items, if any,

Q137: An "above the line" deduction refers to