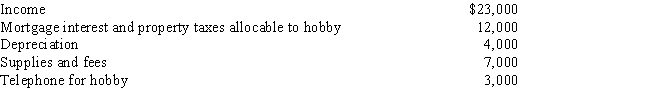

Calculate the net income includible in taxable income for the following hobby:

Definitions:

Profit and Loss Basis

Profit and Loss Basis is a method of accounting that records revenues and expenses as they are earned or incurred, used to determine a company's financial performance over a period.

Liquidation Expenses

Costs associated with converting assets into cash or paying off debt during the winding up of a business.

Book Value

The net value of a company's assets minus its liabilities, often used to assess if a stock is under or overvalued.

Final Settlement

The conclusive resolution of a financial contract's obligation, often through payment or the transfer of assets.

Q6: Norm purchases a new sports utility vehicle

Q16: In 2016, Gail had a § 179

Q19: If a vacation home is determined to

Q25: Any § 179 expense amount that is

Q28: Barney is a full-time graduate student at

Q35: Mary purchased a new five-year class asset

Q36: Velma and Bud divorced. Velma's attorney fee

Q57: The maximum cost recovery method for all

Q151: In which, if any, of the following

Q168: A child who has unearned income of