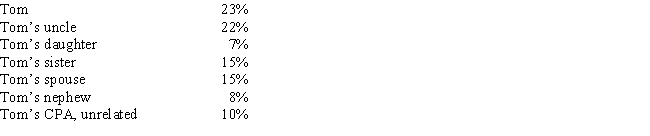

The stock of Eagle, Inc. is owned as follows:

Tom sells land and a building to Eagle, Inc. for $212,000. His adjusted basis for these assets is $225,000. Calculate Tom's realized and recognized loss associated with the sale.

Definitions:

Attachment

An emotional bond between individuals, particularly seen in relationships between parents and children, affecting long-term development and emotional wellbeing.

Conservation

The protection and preservation of the natural environment and wildlife, often emphasizing sustainable practices.

Imprinting

A form of learning in which a very young animal fixes its attention on the first object with which it has visual, auditory, or tactile experience and thereafter follows that object.

Egocentrism

A cognitive bias that causes individuals to interpret the world from their own perspective, often failing to take into account the viewpoints of others.

Q1: Discuss the beneficial tax consequences of an

Q35: Deduction by an employee of unreimbursed office-in-the-home

Q46: If a taxpayer has a net operating

Q46: Which, if any, of the following is

Q50: The cost of a covenant not to

Q67: Five years ago, Tom loaned his son

Q79: Two persons who live in the same

Q84: Roy and Linda were divorced in 2016.

Q92: Are there any exceptions to the rule

Q114: George and Erin are divorced, and George