Essay

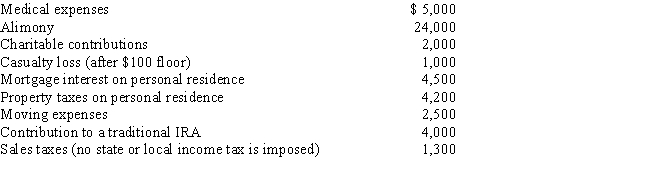

Austin, a single individual with a salary of $100,000, incurred and paid the following expenses during the year:

Calculate Austin's deductions for AGI.

Calculate Austin's deductions for AGI.

Definitions:

Related Questions

Q5: With respect to the prepaid income from

Q17: Darryl, a cash basis taxpayer, gave 1,000

Q30: Discuss the tax consequences of listed property

Q37: If an election is made to defer

Q68: Club dues deductible

Q92: Under the terms of a divorce agreement,

Q94: In the case of a zero interest

Q100: Taxpayer's home was destroyed by a storm

Q146: The legal cost of having a will

Q174: Cathy takes five key clients to a