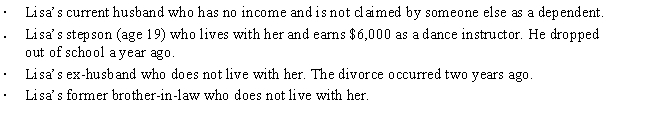

During 2017, Lisa (age 66) furnished more than 50% of the support of the following persons: Presuming all other dependency tests are met, on a separate return how many personal and dependency exemptions may Lisa claim?

Definitions:

Deductible Corporate Expense

Expenses that a corporation can subtract from its gross income to reduce its taxable income, according to tax laws.

Stock Dividend

A dividend payment made by a company to its shareholders in the form of additional shares rather than a cash payout.

Total Assets

The sum of all assets owned by a company, including both current and non-current assets.

Par Value

The nominal or face value of a stock or bond, representing the minimum amount set by the issuing company.

Q4: Jerry purchased a U.S. Series EE savings

Q6: If a lottery prize winner transfers the

Q11: Rachel, who is in the 35% marginal

Q19: Which one of the following statements is

Q27: Heather is a full-time employee of the

Q35: Subchapter D refers to the "Corporate Distributions

Q77: Abandoned spouse

Q86: Which of the following characteristics correctly describes

Q126: In January 2017, Jake's wife dies and

Q142: Which of the following is a required