Essay

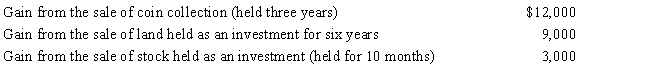

During 2017, Jackson had the following capital gains and losses:

a.How much is Jackson's tax liability if he is in the 15% tax bracket?

b.If his tax bracket is 33% (not 15%)?

Definitions:

Related Questions

Q8: How do treaties fit within tax sources?

Q34: Because Scott is three months delinquent on

Q46: LD Partnership, a cash basis taxpayer, purchases

Q52: Iris, a calendar year cash basis taxpayer,

Q86: Which of the following characteristics correctly describes

Q130: Kyle and Liza are married and under

Q132: An uncle who lives with taxpayer.

Q140: In terms of income tax consequences, abandoned

Q146: The legal cost of having a will

Q156: Sales made by mail order are not