Multiple Choice

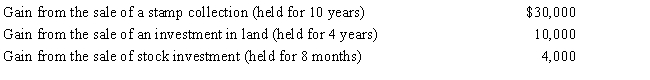

Perry is in the 33% tax bracket. During 2017, he had the following capital asset transactions: Perry's tax consequences from these gains are as follows:

Definitions:

Related Questions

Q8: How do treaties fit within tax sources?

Q12: The Martins have a teenage son who

Q24: Which of the following is not an

Q25: The taxpayer incorrectly took a $5,000 deduction

Q30: Which of the following must be capitalized

Q32: Rhonda has a 30% interest in the

Q35: Frank sold his personal use automobile for

Q41: Proprietary funds are required to prepare financial

Q71: Ellen, age 39 and single, furnishes more

Q138: Before the Sixteenth Amendment to the Constitution