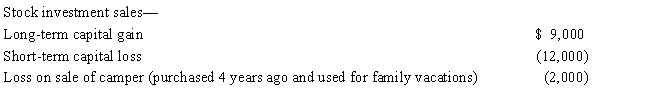

For the current year, David has wages of $80,000 and the following property transactions: What is David's AGI for the current year?

Definitions:

Outlet Covers

Protective devices designed to cover electrical outlets to prevent accidental contact with electrical connectors.

Electrical Cords

Flexible cables used to connect electrical appliances and devices to the main power supply.

Preventing Injury

Measures and practices aimed at reducing the risk of harm or injury in various environments, including workplaces and sports.

Dietary Restrictions

Specific guidelines or limitations on what an individual can eat, often due to health concerns, religious beliefs, or personal choice.

Q27: Roy is considering purchasing land for $10,000.

Q27: The tax law contains various provisions that

Q50: The following citation is correct: Larry G.

Q52: Iris, a calendar year cash basis taxpayer,

Q54: Nicole's employer pays her $150 per month

Q76: Sarah, a widow, is retired and receives

Q82: If a vacation home is classified as

Q105: Benny loaned $100,000 to his controlled corporation.

Q136: Marsha is single, had gross income of

Q138: Dan and Donna are husband and wife