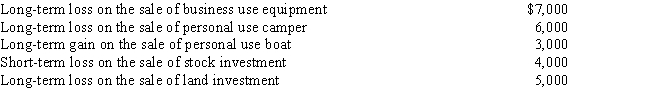

During the year, Irv had the following transactions:

How are these transactions handled for income tax purposes?

Definitions:

Accrued Expense

Expenses incurred but not yet paid or recorded at the end of an accounting period, recognizing expenses when they are incurred, not when they are paid.

Salary Owed

The amount of money that an employer is required to pay to an employee for work performed, which has not yet been paid at the statement date.

Unearned Gym Memberships

Income received by a gym or fitness center from memberships that have been paid for but not yet fully utilized, considered a liability until the services are rendered.

Gym Memberships Revenue

Income received from customers for granting access and use of a gym's facilities.

Q6: Doug and Pattie received the following interest

Q10: Howard, age 82, dies on January 2,

Q16: Andrew, who operates a laundry business, incurred

Q33: The City's municipal golf course had the

Q43: Adam repairs power lines for the Egret

Q80: Which statement is incorrect with respect to

Q88: Katherine is 60 years old and is

Q112: Ed is divorced and maintains a home

Q153: Taylor had the following transactions for 2017:<br>What

Q185: Not all of the states that impose