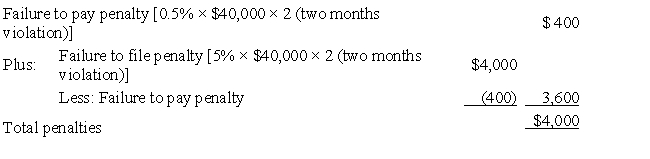

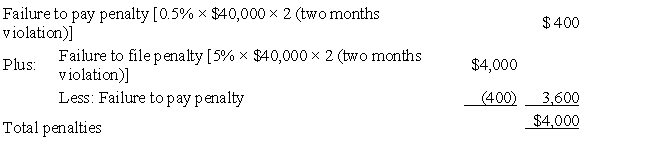

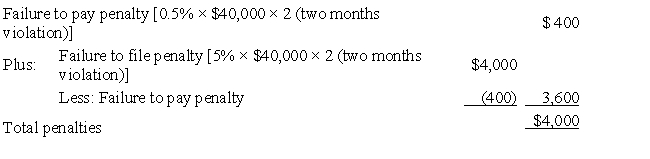

David files his tax return 45 days after the due date. Along with the return, David remits a check for $40,000 which is the balance of the tax owed. Disregarding the interest element, David's total failure to file and to pay penalties are:

Definitions:

Switching

The process of changing from one product, service, technology, or supplier to another, often assessed for cost benefits or efficiency gains.

Net Present Value

A financial metric that calculates the value today of future cash flows, discounted at a particular rate.

Monthly Interest Rate

The interest rate charged on a loan or realized on an investment over a month's time period.

Credit Policy

A set of guidelines that a company follows to determine credit terms for customers, which can impact cash flow and sales.

Q15: Without obtaining an extension, Pam files her

Q26: Distinguish between the jurisdiction of the U.S.

Q32: In reference to the potential taxation of

Q48: Sonja is a United States citizen who

Q50: When the bankruptcy court grants an order

Q109: Kiddie tax applies

Q113: The alimony rules:<br>A)Are based on the principle

Q124: In late June 2017, Art is audited

Q131: With regard to state income taxes, explain

Q183: In an office audit, the audit by