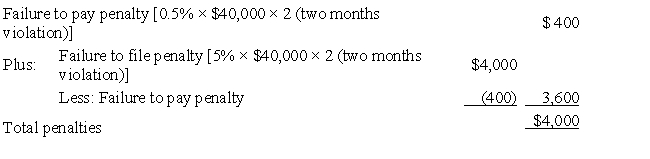

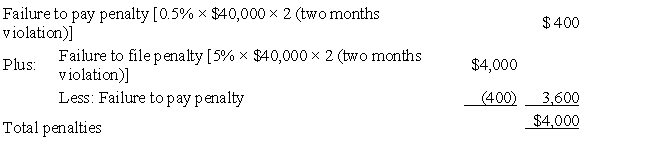

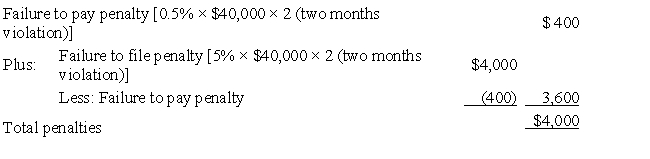

David files his tax return 45 days after the due date. Along with the return, David remits a check for $40,000 which is the balance of the tax owed. Disregarding the interest element, David's total failure to file and to pay penalties are:

Definitions:

Key Stakeholders

Individuals or groups that have a significant interest in or are greatly affected by the outcome of an organization's actions, decisions, or policies.

Board of Directors

A group of individuals elected to represent shareholders and oversee the management and strategic direction of a company.

Top Executive Team

A group of the highest-ranking officers and decision-makers in an organization, responsible for strategic direction and overall management.

Careful Diagnosis

A thorough and meticulous assessment or analysis of a situation, problem, or condition before deciding on a course of action.

Q8: If all partners are included in the

Q33: Old West City had the following transactions

Q49: On December 1, 2016, Daniel, an accrual

Q57: Jason and Peg are married and file

Q61: The Hutters filed a joint return for

Q68: Your client, Connie, won $12,000 in a

Q81: No return and statute limitations

Q118: Kiddie tax may be imposed

Q125: The U.S. (either Federal, state, or local)

Q179: If an individual does not spend funds